“Try to set up partnerships in which new organic chains are created”, is the advice of Alexander Claeys of Bioforum to companies who wish to enter this food market. “Naturally, this also applies to companies who wish to strengthen their position.” What are the opportunities and threats?

“Try to set up partnerships in which new organic chains are created”, is the advice of Alexander Claeys of Bioforum to companies who wish to enter this food market. “Naturally, this also applies to companies who wish to strengthen their position.” What are the opportunities and threats?

Investments in organic products grew by 14% in 2020, partially due to the coronavirus crisis. That is 2% more than the retail market overall. The organic market share in Belgium grew in volume from 3.1% to 3.2%. “That is positive, as this means that prices are remaining stable and the margins for all the links in the chain are good”, summarises the chairman of Bioforum, Alexander Claeys. “That is significant for the organics sector as a whole.” The organic sector has been stimulated by the Europe Farm to Fork strategy and the Flemish strategic organic plan for 2022. From Europe, the ambition is to make 25% or European agriculture organic by 2030. “Funds will be made available to enable farmers to convert.”

Added value

The added value of organic products is the strict specification which is a guarantee of the quality and the certification, which exerts wide control across the entire chain. Sustainability is a high priority. The renewed attention to the future of our food as a consequence of the coronavirus crisis is also positive, which has got the Flemish consumer thinking about locally produced, health, environment, fair price etc... “The consumer has confidence in organic food and the story behind it.”

Communication and transparency

According to Claeys, for further growth, it is important that all of the links, from grower to retailer, communicate and consult with each other transparently. “And that’s not all. All of the links must accept their responsibility.” The chairman is referring in particular to serious contracts that give suppliers security. A good example is the new Corn Bread recently launched by organic bakery De Trog. “Five partners, from grain farmers to retail, have teamed up.”

Switching

Switching from current to organic agriculture takes time. A farmer has to wait two years before he can convert to organic, because production is based on the soil, which needs time to adapt itself to the organic methods. For fruit cultivation, this can even take three years. Processing companies have no switch-over period. This transition is therefore not an obvious process for every company. According to Alexander, we need to ensure that each link in the chain is compensated in the correct way: “Suppliers and food companies must make proper arrangements in this respect. Supply and demand must be in balance.”

“It is always advisable to maintain a critical perspective on your own products and adjust them to contemporary needs where necessary”, emphasises Marijke Adriaens, CEO of frozen food company Fribona. “For consumers, taste is still the main consideration. It is essential to work towards a product that is, above all, tasty and visually appealing.”...

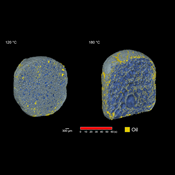

Scientists from KU Leuven have discovered how oil penetrates snacks during and after the frying process. Recent research findings point to advanced frying techniques that reduce oil absorption, as well as innovative methods to limit oil uptake during the cooling phase. This paves the way for the development of healthier snacks without compromising...

Food companies are increasingly targeting a wider range of consumer groups. Speaking at an event organised by Fenavian, Julian Mellentin of New Nutrition Business said this strategy offers significant opportunities to respond to the diverse health needs and interests of today’s consumers. “Consumers enjoy both animal and plant-based proteins”, he...

Backed by financial partners, Start it @KBC is launching the accelerator programme Scale it Agro, aimed at scale-ups offering sustainable and innovative agricultural solutions for agriculture and horticulture businesses. Kjell Clarysse, programme director at Scale it Agro, goes into more detail.