‘The average Belgian is still Burgundian at heart. If producers of prepared meals use additives, it is because they - like the other ingredients - have a purpose. It is a fallacy that all sorts of things are added to meals just for no good reason,’ explains industry federation director Anneleen Vandewynckel.

The prepared meals sector federation represents 66 Belgian companies, where some 2,000 employees work every day to produce high-quality ready meals. These companies realise a combined turnover of €450 million and produce 208,500 tonnes of prepared meals every year. The market is very diverse, and includes everything from retail to schools, retirement homes and aviation. What's more, the sector is on the rise: more and more people are opting for convenience.

High-quality nutrition

By prepared meals we mean all those products that replace a complete meal and are sold to be consumed immediately or after reheating,’ clarifies BReMa’s Anneleen Vandewynckel. ‘The meals we produce are definitely a nutritionally high-quality alternative to meals prepared at home. Manufacturers have optimised their preparation in terms of food safety, quality and the nutritional value of the ingredients.’

Price and quality

‘If the retailer wants to drive down the price, that obviously has consequences in terms of ingredients. A good example is salmon: do people want fresh fillets or frozen, compressed leftover salmon blocks?’ the industry federation director continues. ‘Consumers need to be realistic when buying meals. Prices of basic ingredients like vegetables, potatoes, rice, meat, fish, you name it, have risen exponentially in recent years. This also applies to packaging and energy’.

Retailers

Vandewynckel also has a warning for retailers in Belgium, who are increasingly looking to source internationally. ‘In the Netherlands, for example, I notice that the product quality of prepared meals in supermarkets is still lower than in Belgium. ‘The average Belgian is still Burgundian at heart. The ‘race to the bottom’ in pricing has also become a ‘race to the bottom’ in terms of product quality. This is a pity because we now offer really top quality at a reasonable price.’

Sustainability

She also insists that profit is simply necessary to ensure innovation and, for example, sustainability in the chain. ‘Retail price pressure has its limits. Research and development (R&D) in innovation, food safety, working conditions and sustainability also have their price.’

Logistics

What are the big challenges in terms of ingredients?

‘As well as sustainability, price pressure from retailers and wholesalers, and consistently high product quality - in particular taste, texture and nutritional value - there is also the whole logistics process. If you take the example of prepared meals served in schools, there are some obvious questions: How should they be packaged? How will they be heated? Leftover food is also often taken back. What can be done with these leftovers? are they processed into animal feed or biogas?"

“It is always advisable to maintain a critical perspective on your own products and adjust them to contemporary needs where necessary”, emphasises Marijke Adriaens, CEO of frozen food company Fribona. “For consumers, taste is still the main consideration. It is essential to work towards a product that is, above all, tasty and visually appealing.”...

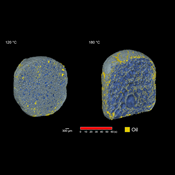

Scientists from KU Leuven have discovered how oil penetrates snacks during and after the frying process. Recent research findings point to advanced frying techniques that reduce oil absorption, as well as innovative methods to limit oil uptake during the cooling phase. This paves the way for the development of healthier snacks without compromising...

Food companies are increasingly targeting a wider range of consumer groups. Speaking at an event organised by Fenavian, Julian Mellentin of New Nutrition Business said this strategy offers significant opportunities to respond to the diverse health needs and interests of today’s consumers. “Consumers enjoy both animal and plant-based proteins”, he...

Backed by financial partners, Start it @KBC is launching the accelerator programme Scale it Agro, aimed at scale-ups offering sustainable and innovative agricultural solutions for agriculture and horticulture businesses. Kjell Clarysse, programme director at Scale it Agro, goes into more detail.